Tokenlon

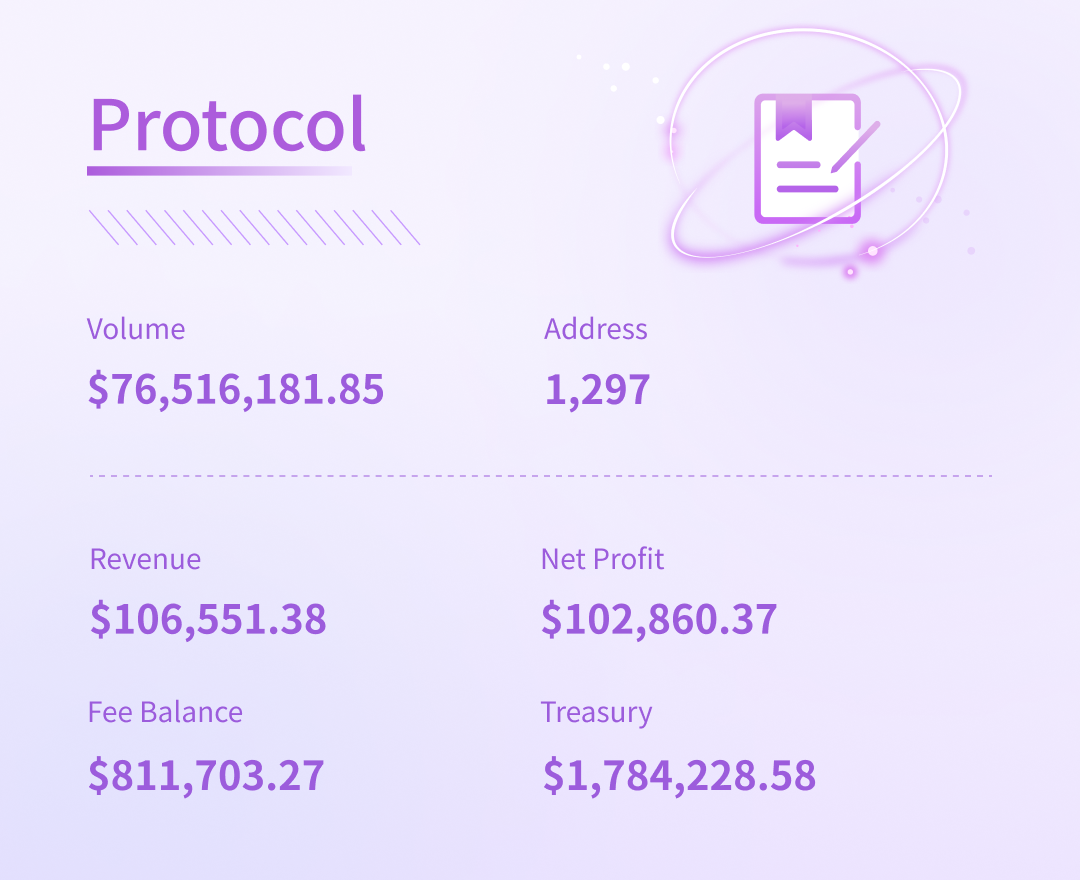

Tokenlon’s trading volume is $76,516,181.85, an increase of 3.29% over last week, with 1,297 weekly trading addresses and 2,906 transactions.

This week, the Tokenlon transaction fee gained $106,551.38, the net profit was $102,860.37, the current transaction fee balance was $811,703.27, with the Tokenlon 5.0 protocol cumulative transaction fee at $43,762,243.39 . The community treasury balance is at $1,784,228.58(without deducting miner fees).

LON

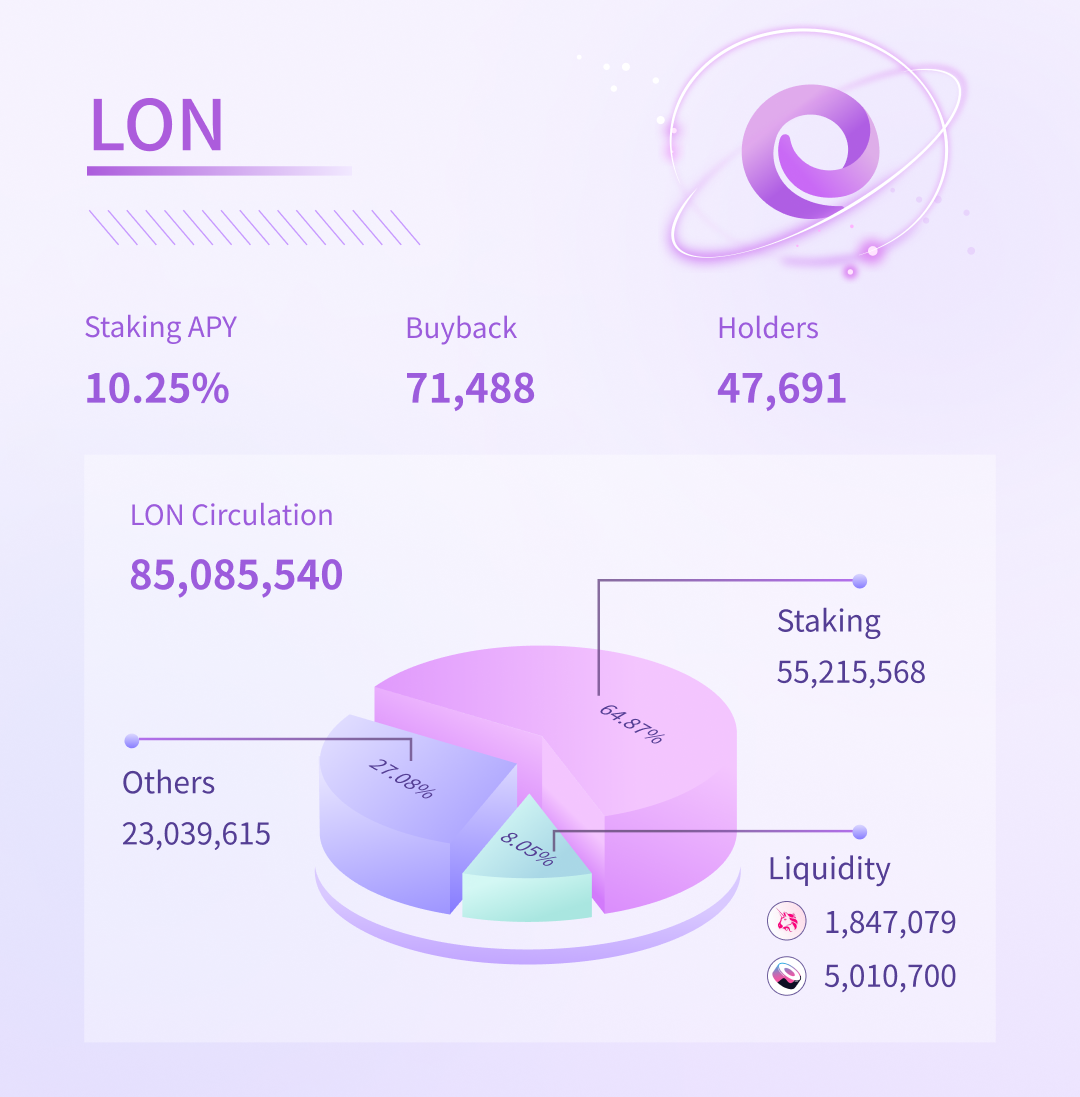

Staked LON is at 55,215,568.37 taking 64.87% of the total staked position. 71,488 LON were bought back this week, and the monthly APY is expected to be 10.25%. Uniswap and Sushiswap AMM liquidity pools staked 6,857,779 LON, accounting for 8.05% of the total staked positions. The cumulative staked LON accounted for more than 72.92%.

Product & Tech

- Limit Order deployment on ETH mainnet

- Combined with UI optimization to do regression testing this week, and will reach the status of pending release in the near future

- Limit Order UI improvements

- Completed development, releasing after China holidays

- Limit Order mobile entry

- Evaluation of the product transformation plan completed, and will be swiftly implemented after the holidays

- WETH tool

- Currently in design stages

- Tokenlon 5.3.0 contract upgrade

- Development of the upgrade timeline and milestones

- NFT research

- Focused on marketplace aggregation this week, and completion of internal technical synchronizations

Marketing & Community

- LON trade mining

- The 15th phase of trade mining has successfully completed. The 14th phase generated a total reward of 655,922.85 LON, and 4,551 addresses participated in this trade mining phase. The total contributed transaction volume is $596,4166,609.76. If you participated in this phase of trade mining, you can check your earnings here.

- Learn & Earn Q&A rewards content preparation

- The campaign will start in October

- Participation in Token2049 in Singapore

- Q3 OKR review & Q4 OKR planning

- A retrospective of Q3 OKRs and complete Q4 roadmaps. Q4 will generally focus on improving and upgrading the Tokenlon protocol.

Tokenlon Services

-

Instant swaps: The main swap on ETH mainnet

- Limit Orders: Deployed on Arbitrum network

Others

A user traded 1.8 million cUSDC on Uniswap and ended up with 500 USDC this week. The extreme slippage was caused by the lack of liquidity on Uniswap’s cUSDC <> USDC pair. The slippage was also caused by the MEV attack.

As a user of Tokenlon though, you don’t need to worry about such issues as Tokenlon automatically checks the on-chain slippage on every trade, as well as our unique RFQ (professional market maker) mode and completely avoid MEV attacks. You can read more about RFQ here.

Important Risk Warning

- LON token contract address:

0x0000000000095413afC295d19EDeb1Ad7B71c952 - Beware of scams!

Tokenlon,

2022.09.30

Contact us

Notes

Digital Assets are highly volatile and unpredictable. Please do your research before trading.