We released the Tokenlon 5.0 on December 23, 2020. As of 2021.03.12, USD 9.55 million have been accumulated in the Tokenlon fee contract. Substracting the cost of 2260 ETH (approximately USD 4.05 million) that Tokenlon pays for the user’s miner fee, net fee income is USD 5.5 million; that is for Tokenlon 5.0, which has been online for 80 days.

With Tokenlon 5.0, users get access to the liquidity of Uniswap, SushiSwap and Curve. We upgraded Tokenlon from a DEX, that relies solely on an RFQ design with professional market makers to an aggregated DEX that combines RFQ and AMM, providing users with a richer liquidity and more tokens.

You can find Tokenlon fees are deposited on the following three contract addresses:

-

PMM: 0x8D90113A1e286a5aB3e496fbD1853F265e5913c6

-

AMM1: 0x11be6f5520FEE8E867e20AF9C9D2c8A09b909B83

-

AMM2: 0x904144473FdE753dc0729608CfeEA6F4A8B275E6

The accumulated funds respectively are: $7.017 million, $0.737 million and $1.796 million.

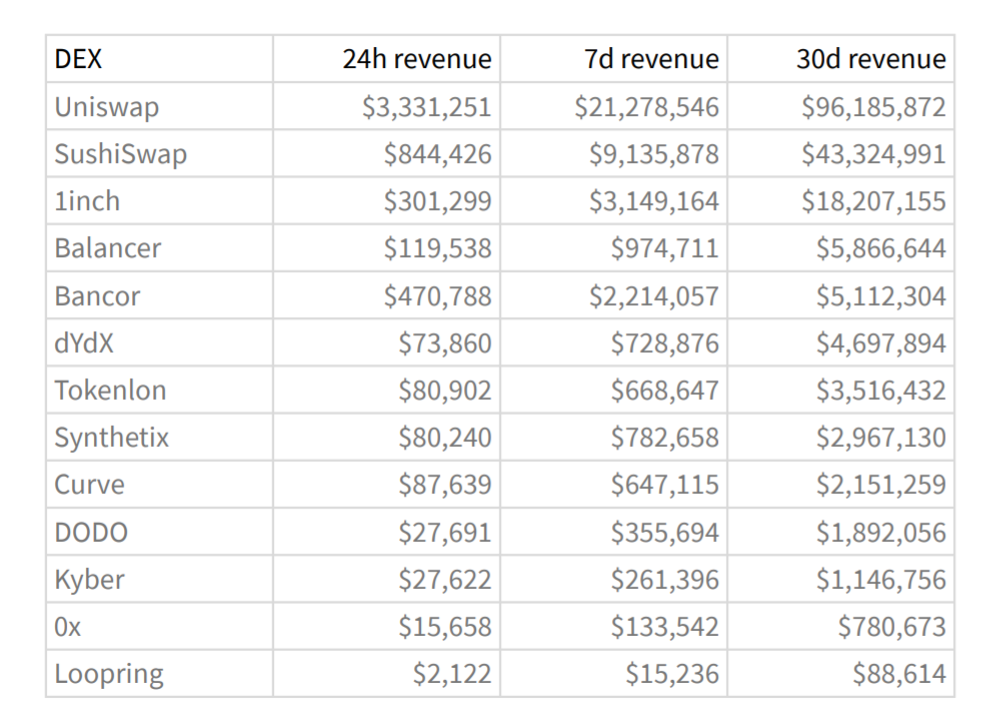

In comparison, Tokenlon's income level ranks seventh among the top ten DEX. Referring to the DEX income statistics of Token Terminal:

Looks good? Even more interesting, here is what the Litepaper has in plan for Tokenlon soon:

-

Opening the LON buyback mechanism

-

Starting LON staking

-

Restarting trade mining

Stay tuned for updates!

Let’s also answer recent question that use to come up in our Discord:

-

When does Tokenlon pay the miner fees for traders?

When you exchange ETH to other tokens, the transaction miner fee is paid by you, the user. When you exchange tokens to tokens or ETH, in order to prevent the transaction from being unable to proceed normally due to the user's zero ETH or insufficient quantity, Tokenlon pays on-chain fees on your behalf. This mechanism helps users to complete transactions on the chain.

This means that even if the transaction fails on the chain, the user does not need to bear the loss of the miner's fee, which is borne by Tokenlon.

https://tokenlon.zendesk.com/hc/en-us/articles/360037260272-Fees -

What is the composition of funds in a fee contract?

The Tokenlon fee contract is mainly composed of transaction fee and additional miner fee payments . Among them, the detailed data on the payment of miner fees can be viewed through the on-chain data tool Dune Analytics:

https://duneanalytics.com/Fan/tokenlon-v5-trade-bot-gas_eth-cost

Since Tokenlon version 5.0 went live, the cumulative miner fee paid is 2260 ETH. -

When will Tokenlon support more trading pairs?

Since Tokenlon 5.0 accesses the liquidity of Uniswap, Sushiswap, and Curve, we were able to add a lot more trading pairs.

At present, the core team selects assets from the community to whitelist and executes the listing after checking the liquidity. In order to introduce the community to participate in decision-making, the core team began to join the governance process, and the community voted to determine the support of new assets. More popular trading tokens are to come.

At the same time, the Tokenlon core team is also studying and considering opening up tokens, and fully open the liquidity of the connected DEX such as Uniswap to users. However, this will be done under the premise of ensuring that the user's trading slippage is controllable, and avoiding hurting the user's trading experience or even loss due to the slippage problem.

Tokenlon,

2021.03.15